Energy Security Intelligence Research

ESIR

ESG STRATEGY RISK and COMPLIANCE PLANNING AGENDA 2050

Newsletter

Thanks for Signing Up for the Newsletter

In ESIR we deliver Oil and Gas market insights, consultancy and advisory by putting our clients first in understanding energy markets dynamics in Asia Pacific, Europe, North America, Middle East and Africa.

Your company will benefit from our risk assessment, portfolio management, strategy for short and long term investment in the energy sector; production margins and structuring your assets.

Other benefits in our research and publications will also help your company in dealing with uncertainty, entering new markerts, political and economic risks; and regulatory structures in energy industry environment.

Monthly Newsletter- February 2017: Guyana's new crude frontier

The 2015 oil discovery at Liza, offshore Guyana, was a landmark well. It marked the end of an eight-year campaign to find a follow-up to the 1.8bn-barrel Jubilee play, which opened Ghana's Tano Basin in 2007. The search, along what is known as the Atlantic Transform Margin, had until now proved elusive: 24 unsuccessful wells had been drilled at a cost of $3.4bn (probably more than $6bn when seismic and general and administrative costs are included).

Like Jubilee, the trap at Liza appears subtle and largely stratigraphic in nature: one not easily seen in the seismic data without sophisticated geophysical processing. The geological age of the source rock and reservoir are similar, consisting of Late Cretaceous deep-water sandstone reservoirs overlying rich Late Cretaceous aged source rocks. Operator ExxonMobil reported 90 meters (m) of net oil pay and has been upbeat about the discovery.

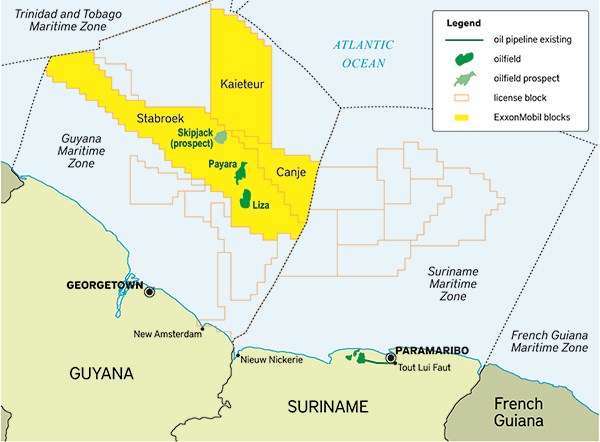

The Stabroek licence, where the Liza discovery was made, was first issued to Exxon in 1999. It is huge, covering 26,800 square kms (6.6m acres). Hess and Cnooc/Nexen entered the licence through a farm-in in 2014 (Exxon 45%, Hess 30%, Cnooc 25%). But Liza has caused a few red faces too. Shell chose to leave the licence before drilling and many other companies turned down the chance to buy a stake.

Exxon moved quickly into early engineering studies and an appraisal programme designed to delineate the field and test for reservoir continuity. On 30 June 2016, the company announced that Liza-2 had met 58m of oil pay and estimated the recoverable resource at 0.8bn-1.4bn barrels of oil equivalent. The Liza-3 appraisal well was completed in October 2016 and Hess indicated that, based on the result, the estimated recoverable resources were now at the upper end of the range. Significant associated gas volume contributes to the resource and the initial development plans show it will be re-injected.

The field was declared commercially viable in November 2016 after four reservoir penetrations-just 18 months after discovery-and a field-development plan has recently been submitted to Guyana's government for approval. A staged floating, production, storage and offloading (FPSO) development looks likely, with an initial production capacity of 100,000 barrels a day, potentially increasing to around 200,000 b/d when the field is fully developed. A preliminary published plan showed an initial 17-well development including producers, water injectors and gas injectors across two drill centres feeding a 100,000-b/d-capacity FPSO.

Acreage in the play has been licensed under fiscal terms that reflected its frontier nature when the drillers arrived. Guyana's production-sharing agreement model is fairly simple, with a 75% cost-recovery cap and a 50:50 profit share with no tax or royalties to be paid. Fiscal terms for new licences will reflect the lower risk and contractor shares will be lower. Preliminary economic modelling by Richmond Energy suggests the field could have a break-even oil price in the low $30s.

The first follow-on exploration test to Liza at the Skipjack prospect was disappointing-the reservoir was present but no hydrocarbons were found. Hess reported that seismic studies carried out before drilling suggested the presence of oil. This suggests that even with two Liza wells to calibrate seismic data, direct detection of hydrocarbons from seismic data could not yet be done with confidence. The next test well, Payara, is similar, but smaller, and located between the successful Liza and dry Skipjack wells. At the time of writing the test results had not yet been made public but companies with acreage nearby are planning more test wells. Tullow Oil, Kosmos Energy and Apache all plan to drill new wells in 2017 in the adjacent Suriname waters, but they won't necessarily target the same play.

The jury is still out as to whether Guyana-Suriname is the multi-billion-barrel basin the industry has been searching for, or if it is on the same scale as Ghana's 2bn-3bn-barrel oil province. But Exxon has moved quickly to snap up as much acreage as possible, leaving little available to other operators in either Guyana's or Suriname's waters.

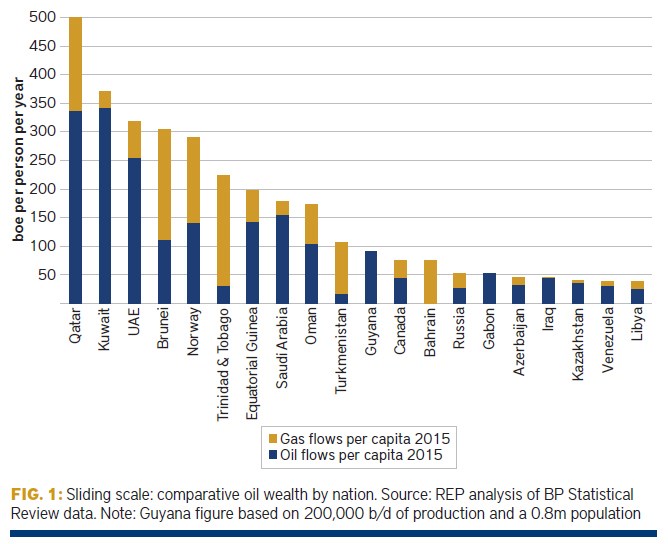

Success at Liza could also be important politically for Guyana. With a population of just 0.8m, oil production could make the country the highest per capita oil producer in South America. Output of 200,000 b/d would equate to 91 barrels per person, per year, or three times that of neighbouring Venezuela.

Richmond Energy estimates that with oil prices of $60/b, government revenue could peak at around $2bn per year. This compares to just $1.1bn in 2016. Guyana's windfall will need careful managing.

A black/Asian-Indian ethnic split-a post-colonial legacy-dominates the country's political landscape. The present coalition government, comprised of A Partnership for National Unity (APNU) and the Alliance For Change (AFC), took power in May 2015 after winning a narrow majority over the People's Progressive Party, which had held power for 23 years. The APNU/AFC government is relatively inexperienced and will be cautious in its approach to the country's upstream, balancing the need to keep investors happy with the imperative to put institutions in place, including a sovereign-wealth fund, to manage the oil windfall.

Guyana's windfall has irked Venezuela, which has long held a claim to over half of its neighbour's territory. Guyana is confident in its case and has referred the dispute to the UN. But Venezuela probably wouldn't accept a UN ruling that wasn't in its favour. The current boundary was set in an 1899 tribunal that favoured Guyana. It was reasserted when Guyana claimed independence in a 1966 Geneva agreement despite Venezuela consistently challenging it. Venezuela has held claims to large areas of land up to the Essequibo river, about 60% of Guyana's total land area. Venezuelan President Nicolás Maduro has issued a decree claiming most of Guyana's continental shelf, and even some of Suriname's, exposing the country to possible aggression. This could create complications for upstream operators. The government will probably want to keep the Exxon-operated Stabroek licence intact for as long as possible within the disputed maritime area.

And Guyana will want to avoid the mistakes made in Ghana. It brought the Jubilee project on stream in record time, just three years after discovery. But oil production levels and state revenues have been disappointing due to operational mishaps, government mismanagement. and its maritime-border dispute with Côte d'Ivoire, which has interrupted exploration. The development of the Liza discovery, and Guyana's future, depends on it.

"The Liza oil find offers the promise of an economic boost for the country but the government must plot its course carefully"

Monthly Newsletter-May 2017: Technology and the oil industry

The digital oilfield has been a buzzword bouncing around the industry for at least a decade but its time might finally be arriving in the oil patch. Technological advances are coinciding with one of the most severe disruptions the oil industry has seen in generations, which has left companies looking for new answers to a seminal question: how to cope with what may be years of lower prices.

The renewed enthusiasm for all things tech was on display at this year's CERAWeek conference in Houston, the US' biggest industry confab. Views on prices and policies from executives and ministers drew the usual headlines, but the more lasting and transformational story may have been taking place in the halls of the annual conference, where digital pioneers showed off their latest wares.

ABB, which develops new industrial technologies, let visitors slip on a virtual-reality headset that transported them to a simulated Mars base camp. There, autonomous vehicles and robots beavered away, a microgrid supplied power, and advanced sensors monitored the action, allowing the whole operation to be operated remotely-all technologies that exist today. No one is going to be drilling for oil on Mars anytime soon, but it's not hard to see how a similar suite of technologies couldn't run a project more efficiently and safely in forbidding Arctic or offshore environs. Or even in a less hostile setting like West Texas' shale fields.

Honeywell put virtual reality to work as well, showing how the technology could be used to more effectively train staff by bringing companies' facilities to life in the virtual world. CyPhy Works had a drone that, unlike hobby models, is tethered to a power supply and data-collecting base so it can be deployed to continuously monitor refineries, offshore installations or tank farms. Maana, a data and analytics firm, showed how it was using machine learning to help companies pull vast amounts of disparate data together to help petroleum engineers squeeze more crude from each of their wells.

A new technology-focused side forum called Agora was also launched this year at CERAWeek. It was a hit. Sessions named artificial intelligence, machine learning and energy: an explosive combination and Agile, additive, autonomous-Technology and the reshaping of the energy supply chain drew overflow crowds, even if some in the audience seemed slightly bewildered about what it could all mean for their businesses.

It pointed to a collective sense from the execs that their industry is missing out on the wonders of 21st century technologies like automation, big-data analytics and artificial intelligence that have transformed so many other industries, but have barely touched the oil and gas industry. "We are way behind Silicon Valley," Anadarko's president Al Walker lamented, echoing a refrain running throughout the conference. Pointing to his own company's struggles to make the most of its vast flow of data, Walker said his company "was collecting terabytes and terabytes of data, but only using maybe 5% of it".

It isn't just Silicon Valley-the oil and gas industry has fallen behind most industries in taking up new digital technologies, argued Lisa Davis, the head of Siemens's global energy business. "We do business in automotive, trains and mobility, healthcare, food and beverage and elsewhere and you see a lot more advancements in other industries than you do in oil and gas," said Davis. The mining industry, for instance, faced in recent years with a supply glut and low prices-an experience like the oil business' own-has been embracing technology such as autonomously driven vehicles and robotic drilling to save cash.

The relatively slow uptake from the industry means there is still huge scope to transform the ways oil and gas is produced, transported, refined and, ultimately, consumed. And as companies look to the technologies available, the shape of the industry's digital future is becoming clearer.

Take shale drilling, for instance. A full embrace of drones, robotics, automation, artificial intelligence and remote operations could revolutionise the way companies go about developing their fields. At the well site, much of the repetitive and heavy lifting tasks could be done by robots running nearly fully automated rigs. Downhole sensors would track goings on below ground while drones monitor the site from above, both sending real-time information back to a central operations centre, where engineers are able to manage multiple projects simultaneously. The rigs would be able to move themselves from site to site. At the same time, artificial-intelligence platforms would analyse the vast streams of data arriving from the wellsite and store it in the company's cloud to help engineers decide on everything from well siting, to completion formulas, to optimal artificial-lift equipment, constantly pulling in technical and economic data to help perfect field development. Soon, petroleum engineers could be asking Siri where they should drill their next well.

The robots are coming

Much of the technology already exists, or is being developed. Robotics Drilling System, for instance, is working with Energid Technologies and Odfjell Drilling on a fully automated drill floor, replacing roughnecks with robots. Schlumberger's "rig of the future" initiative is aiming to pull together all these features into a complete suite of services it can sell to producers. GE's takeover of Baker Hughes signals an attempt to move the industry in this direction.

In data and analytics, Repsol is working with IBM's Watson, famous for trouncing its human opponents in the US quiz show Jeopardy, to help it manage oil reservoirs and decide on where to bid on oilfields. Other companies, especially in the midstream and downstream, are using the data from their facilities to predict when failures and breakdowns are likely to occur. Apache is using predictive analytics to monitor thousands of downhole pumps across its operations to minimise production losses due to failing equipment.

Advances in the sensors that collect all this data are also crucial. BP has deployed tiny, yet highly resilient, specialised sensors that can be sent deep into a well to detect encroaching water that can damage the reservoir and halt output. The developer, Silicon Microgravity, says the sensors can lift yields from conventional reservoirs by 2%. This may not sound like a significant amount but it could potentially unlock billions of barrels of oil.

"The industry is starting to embrace things like big data and analytics," ConocoPhillips's boss Ryan Lance said at CERAWeek. "Big data," he added "is changing the way we understand the shale plays."

Still, a digital revolution feels far off. The current patchwork of mostly incompatible sensors and platforms used to collect, process and analyse data have not been standardised across the industry in a way that allows the sort of sharing that makes the most of things like machine learning and artificial intelligence. Silicon Valley's ethos of open-source development, which has helped accelerate innovation, is anathema to most oil and gas companies. The industry has always held on to information tightly, and been reluctant to share data with suppliers and contractors, for fear it might end up in a competitor's hands.

The industry also remains conservative and resistant to new technologies-sometimes for good reason. The cost of failure in the oil and gas business is far higher than in most industries, especially around Silicon Valley. A well blow out or oil spill is far more serious than a buggy app rollout. But the industry, especially the majors, could be much more embracing of new technology. George Mitchell transformed the sector by taking an incredible financial and reputational risk in pioneering the use of horizontal drilling and fracking on oil- and gas-rich shale formations. He failed repeatedly before cracking the code.

Accenture, a consultancy, said in a recent report that more than $1 trillion in value could be unlocked across the energy sector over the next decade alone if digital tools were widely adopted.

That's an opportunity which is too great to ignore, especially as the industry enters an era when companies are fighting for survival. Gaining an edge on costs could make or break them.

Therefore, "automation, machine learning, artificial intelligence and other new technologies could transform the oil industry".

Monthly Newsletter: 31st July 2017-Upstream spending slides, cost-cutting kicks in

Investment in the oil and gas sector fell by 26% to $0.65 trillion in 2016, partly thanks to less drilling as the low oil price hit investment—but also because upstream players have made big strides in cutting costs.

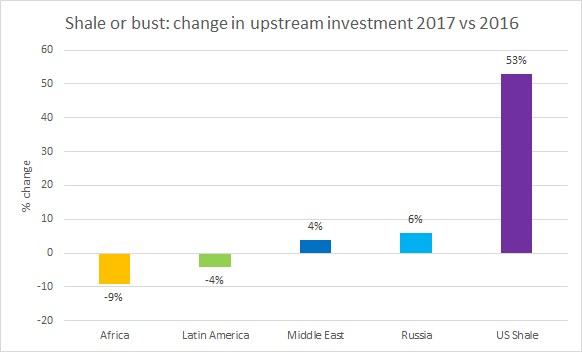

In its World Energy Investment 2017 report, the International Energy Agency (IEA) also forecasts that upstream spending will rebound slightly in 2017, by 3% in real terms—a rise largely driven by a 53% increase in US shale investment and resilient spending in the Middle East and Russia.

Evidence of an uptick in investment elsewhere is visible too. Wood Mackenzie reports that the number of upstream projects reaching final investment decision in 2017 could double to 25 compared with only 12 in 2016.

The IEA says that, while costs would be expected to fall when less drilling is going on during the oil-price downturn, improved efficiency have helped firms save cash. Global upstream oil and gas costs fell 17% in 2016 and, the US shale sector apart, are expected to decline for a third consecutive year in 2017, though more slowly. That could signify a sea change in the way the industry operates.

"Oil and gas companies have improved capital costs and operational efficiency to an extent that could herald a structural break with the past," the agency says in the report.

The industry has long been criticised—often from within—for failing to operate as efficiently as it could. Producers could get away with that when oil was $100 a barrel, but no longer. If the IEA is right, the leaner operating model might put drillers on a more sustainable financial footing.

They will need to be, as costs are also falling among rival energy sources, notably renewables. Solar photovoltaic unit capital costs fell by 20% in 2016, according to the IEA.

Nuclear and hydro hold back renewables

But while solar and wind power are making rapid gains, alternative energy overall is failing to raise their share of the new energy investment pie, because investment in nuclear and hydropower have declined.

Taken together, spending in wind, solar, hydropower and nuclear in terms of planned new generating capacity declined in 2016. The main loser here was hydropower, which failed to match a bumper year in 2015 driven by final investment decisions on big projects in China and Brazil. This failure to boost renewables across the board jeopardises the move towards clean energy at the expense of fossil fuels, the agency says.

"While the expected generation from newly sanctioned solar PV and wind capacity has grown by around three quarters over the past five years, that from final investment decisions for nuclear and hydropower declined by around 55% over the same time frame. As a result, the expected low-carbon generation from sanctioned new facilities is not keeping pace with demand growth, falling far short of what is needed for the low carbon transition," the agency says.

It also notes that in China, the growth in hydro and nuclear generation in 2016 each had a larger impact on Chinese emissions than solar PV by a factor of four, even though China was the world's largest investor in solar.

Meanwhile, although electric vehicle sales continued to grow, low oil prices spurred a 2.4% rise in gasoline demand, a higher rate than the previous five years. Transportation sector emissions-continued to rise as a result.

Overall, global energy-related CO2 emissions remained roughly flat in 2016 for the third consecutive year, a result of greater energy efficiency, coal-to-gas switching and the cumulative impact of low-carbon generation, the IEA reports.

Rising US shale gas production enabled more than 1% of global coal generation to be replaced by gas in 2016, while wind and solar PV capacity additions rose to a record 125 gigawatts.

Investment flows

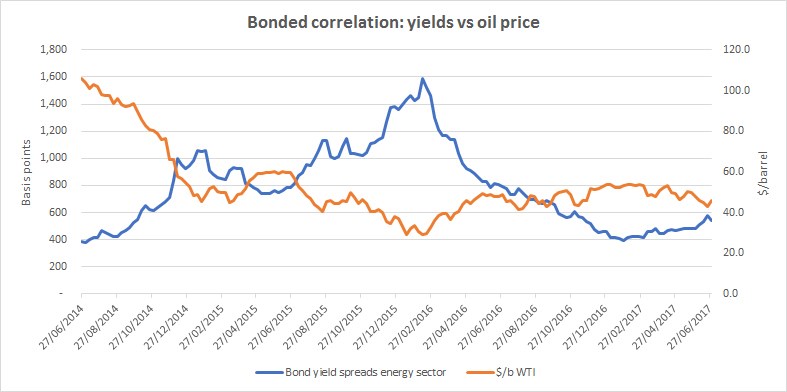

Oil companies have needed to be fleet on their feet to maintain access to investment when needed. This was a struggle for US independent oil firms, which work predominantly in the shale sector, in 2016, as they typically carry more debt than other oil companies and rely more heavily on bond markets for funding. A slide in the oil price sent bond prices soaring.

However, the IEA found that, on the whole, the lower oil price did not significantly affect funding mechanisms for oil and gas investments, even if much of the sector became more highly leveraged.

"For the majors, cash flow remained the main source of finance, though net debt increased by over $100bn between mid-2014 and early 2017. US independents, with a more leveraged business model, initially saw debt costs soar, but their financial health has improved thanks to efficiency gains and the lower cost of debt. They continue to rely heavily on asset sales and external equity financing," the agency reports.

But a slump in sanctioning of new conventional oil projects could lead to tighter oil supply in the near future.

"Given depletion of existing fields, the pace of investment in conventional fields will need to rise to avoid a supply squeeze, even on optimistic assumptions about technology and the impact of climate policies on oil demand. The energy transition has barely begun in the transportation and industrial sectors, which will rely heavily on oil, gas and coal for the foreseeable future," the IEA says.

Uncertainty over the longer-term trading environment and a desire to get oil to market as quickly as possible are among factors driving a move to shorter project cycles in the oil sector, along with the development of technology to make it possible to speed up the development process.

The debate brewing among oil company shareholders over whether investment in longer-term mega-projects could be wasted if oil demand slumps and strands the assets may also be informing this push towards projects with shorter-term returns.

Monthly Newsletter: 30 August 2017-Record-breaking clean energy investment overtakes fossil fuel spending

Last year spending (2016) in the electricity sector overtook investment in the fossil fuel industry for the first time ever, according to the IEA's recently-released World Energy Investment 2017 report—a barometer for spending across the entire energy industry.

Capital investment in global oil and gas supply fell by 38% between 2014 and 2016, the IEA said, but still comprises around 40% of the total. This drop has allowed spending on low-carbon energy supply, including electricity networks, to reach a record 43% of the global, total spend last year in 2016. This is a rise of 12% from 2014 levels.

Global electricity investment was down just 1% at $718bn, with growing network spending mostly offset by fewer coal-fired power plant additions.

Investment in renewable-based power capacity was the largest area of electricity spending. According to the report, progress in technology and project management is driving down solar and wind costs, which has led to investment in renewables falling 3% to $297bn. The IEA notes, however, that renewables will generate 35% more power as they become cheaper and technology in solar PV and wind develops.

"The biggest area of power generation investment is renewable, low-carbon generation," said IEA chief economist Laszlo Varro. "Wind and solar power have been doing very, very well and 2016 was a record year. We can expect 200 TWh of electricity from the wind and solar investment [made] in 2016."

Notably, China, the world's largest energy investor, saw a 25% decline in coal-fired power investment last year, as it is increasingly driven by clean electricity generation and networks, as well as energy efficiency investment.

In 2016, total global investment across the entire energy sector fell by 12%, from a year earlier, to $1.7 trillion—or 2.2% of global GDP.

It was the second, consecutive year of declining overall investment. This was because higher spending on energy efficiency and electricity networks failed to offset a 44% drop in upstream oil and gas spending between 2014 and 2016, the IEA said.

A prolonged period of depressed oil prices and advances in technology, which have helped to reduce costs for both producing electricity from renewable energy and oil and gas drilling, have also helped to slash overall investment levels.

However, so far in 2017 there has been a modest rebound. A 53% rise in US shale oil and gas investment, combined with resilient spending in large oil and gas producing regions such as the Middle East and Russia has driven nominal upstream investment 6% higher in 2017 (a 3% increase in real terms). Notably, it says the oil and gas sector is getting better at cutting costs.

"The oil and gas industry is undertaking a major transformation in the way it operates, with an increased focus on activities delivering paybacks in a shorter period of time and the sanctioning of simplified and streamlined projects," the report says. Therefore, as capital spending across the fossil fuel industry continues to fall, investment in low carbon energy is thriving, helping to push electricity sector capex to record levels, according to the International Energy Agency (IEA)

Monthly Newsletter: September 2017-Total's M&A with Maersk Oil

An oil company committed to building economies of scale and acquiring assets at the bottom of the market is buying a division operating in similar areas from a company that wants out of the oil business. Total's acquisition of Maerskoil from AP Moller-Maersk looks like an ideal fit.

Total is buying the Danish firm's hydrocarbons unit in a $7.45bn deal, in which AP Moller-Maersk will receive $4.95bn in Total shares, while Total will take on $2.5bn of Maersk Oil debt. On top of the headline figures, down the line, Total will also be liable for Maersk's decommissioning obligations in the North Sea, which are around $3bn. Assuming the deal is approved, it is expected to close in the first quarter of 2018.

According to Total, the acquisition brings the French company additional 2P and 2C reserves of around 1bn barrels of oil equivalent—80% of this in the North Sea—and will add some 160,000 boe per day of production in 2018. Much of this is located in areas of the world where Total already has a strong presence or wants to bolster its profile.

Maersk Oil has a 49.99% stake in—and is operator of—the giant Culzean field in the North Sea, which could be meeting around 5% of UK gas demand by the early 2020s. It also has an 8.44% stake in Norway's offshore Johan Sverdrup project, operated by Statoil, based on one of the largest North Sea finds of recent years, with estimated resources of around 2bn-3bn boe.

The deal reinforces Total's position as one of the major players in the North Sea and should also fortify its position in other regions too, notably Algeria and Iran, where both firms have assets in the South Pars gas field.

Despite the juicy looking assets, there is no doubt that what risk there is lies on Total's side, while Maersk's parent can now make good on the intention of its chief executive, Søren Skou, to bail out of the oil and gas sector and focus on transport and logistics. These factors were perhaps responsible for a sharp jump in AP Moller-Maersk's share price immediately after the announcement of the deal, and a slight fall in Total's.

However even a transaction worth almost $7.5bn is not too much of a gamble for oil and gas major Total, which has a market capitalisation of well over $100bn and whose cost-cutting early in the industry's post-oil price crash down-cycle has left its balance sheet looking healthier than many of its rivals. Total says it was the only major company in the hunt to buy Maersk Oil.

The extent to which the acquisition pays off for the French company won't be clear for two or three years, when consolidation of staff and assets has progressed sufficiently. Total chief executive Patrick Pouyanné estimates consolidation of the two companies' operations could cut costs by more than $400m a year from 2020, with most savings coming from the North Sea region, where job losses are likely.

Total's capital expenditure forecast of some $15bn-17bn for 2018 remains unchanged, reflecting the company's bullish outlook.

The acquisition shows piqued interest in mergers and acquisitions among the industry's major players, which deem this the right time to pick up smaller players—or their assets —that have been buffeted for almost three years by the impact of low oil prices. ExxonMobil and BP are among those that have made sizeable asset acquisitions over the last year or so, headed by Exxon's purchase of fresh acreage in the US Permian basin for around $6bn. Total itself agreed to buy some $2bn of assets from Brazil's Petrobras last December.

For AP Moller-Maersk, the sale saves the company the headache of spinning off Maersk Oil via an initial public offering, which had tentatively been planned for next year, and must be regarded as something of a coup for Søren Skou, who has more or less severed the company's ties with upstream at one stroke—though it does retain exposure to the oil industry, given its 3.75% stake in Total, resulting from the deal, and, of course its fleet of oil products and LNG tankers.

Market observers will now be watching to see if Total's willingness to indulge in costly M&A activity will spur others to do the same.

OPEC+ Approves Historic Oil Cut Amid Coronavirus Pandemic 04 April 2020

OPEC and allies led by Russia agreed on Sunday to cut oil output by a record amount - representing around 10% of global supply - to support oil prices amid the coronavirus pandemic, and sources said effective cuts could amount to as much as 20%.

Measures to slow the spread of the coronavirus have destroyed demand for fuel and driven down oil prices, straining budgets of oil producers and hammering the U.S. shale industry, which is more vulnerable to low prices due to its higher costs.

The group, known as OPEC+, said it had agreed to reduce output by 9.7 million barrels per day (bpd) for May-June, after four days of marathon talks and following pressure from U.S. President Donald Trump to arrest the price decline.

In the biggest oil output cut ever, exceeding four times the cuts approves during the 2008 financial crisis, the countries will keep gradually decreasing curbs on production in place for two years until April 2022.

"The big Oil Deal with OPEC+ is done. This will save hundreds of thousands of energy jobs in the United States," Trump wrote on Twitter, thanking Russian President Vladimir Putin and Saudi King Salman for pushing the deal through.

"I just spoke to them... Great deal for all," Trump said.

OPEC+ has said it wanted producers outside the group, such as the United States, Canada, Brazil and Norway, to cut a further 5% or 5 million bpd.

Three OPEC+ sources said effective oil output cuts could be close to 20 million bpd if contributions from non-members, steeper voluntary cuts by some OPEC+ members and strategic stocks purchases were taken into account.

Gulf members of the Organization of the Petroleum Exporting Countries would be cutting output more steeply than agreed, OPEC+ sources said.

The sources said the International Energy Agency (IEA) would announce purchases into stocks by its members on Monday. The IEA did not immediately respond to a request for comment.

Severe Distress

Trump had threatened OPEC leader Saudi Arabia with oil tariffs and other measures if it did not fix the market's oversupply problem as low prices have put the U.S. oil industry, the world's largest, in severe distress.

Canada and Norway had signalled willingness to cut and the United States, where legislation makes it hard to act in tandem with cartels such as OPEC, said its output would fall steeply by itself this year due to low prices.

The OPEC+ deal had been delayed since Thursday, however, after Mexico, worried about derailing its plans to revive heavily indebted state oil company Pemex, balked at the production cuts it was asked to make.

Mexican President Andres Manuel Lopez Obrador said on Friday that Trump had offered to make extra U.S. cuts on his behalf, an unusual offer by a Trump who has long railed against OPEC.

Trump said Washington would help Mexico by picking up "some of the slack" and being reimbursed later. He did not say how this would work.

A previous agreement by OPEC+ to cut production this year fell apart because of a dispute between Russia and Saudi Arabia, triggering a price war that brought a flood of supply just as demand for fuel was crushed by the coronavirus pandemic.

Global oil demand is estimated to have fallen by a third as more than 3 billion people are locked down in their homes due to the outbreak.

An 10-15% cut in supply might not be enough to arrest the price decline, banks Goldman Sachs and UBS predicted last week, saying Brent prices would fall back to $20 per barrel from $32 at the moment and $70 at the start of the year.